As would be expected, such a realization struck me as being a rather astonishing and impressive statistic, especially in light of the fact that it actually hadn't dawned on me that that was the case... until doc told me. But his comment also immediately inspired another thought to come to mind. And that thought was this: "Really doc? Since I actually pay more attention to the high risk stocks for faster signals I hadn't even realized that the S&P has been up 9 of the 10 past weeks. The Russell sure hasn't!". So I was suddenly shaken out of my stupor by doc's comment and immediately dived into the following analysis, one which I've been totally remiss in failing to investigate for over a year.

There's little doubt that a good percentage of the investing public is aware that in good times, times when there is little fear of a stock market pullback, the higher risk stocks outperform the benchmark S&P 500. It's a reflection of the attitude toward taking a higher degree of risk without too much fear of suffering losses. Both the private retail investor community and especially the corporate sector participate in the orgy, more often than not with reckless abandon. There are so many different methods of measuring the appetite for risk and most of them are very reliable. In the currency arena, the Aussie:Yen cross has simply been outstanding in its direct correlation with the S&P 500. Measuring the relationship between the consumer staples stocks and the consumer discretionary stocks is just another in a long list of vehicles that can be used to measure the relative degree of complacency. The much misunderstood and usually misused VIX is another. But there probably isn't a more direct measure of the appetite for risk than simply comparing the higher risk Russell 2000 with the S&P itself. And that's something I admit that I've forgotten to do for quite some time until I was jolted out of slumber by doctor_jr. For those of you who have never played hockey, I can assure you that there's nothing like a good solid body check to wake a guy up. And I was always under the impression that doc was a basketball guy! Go figure!!

In the series of charts below I'd like to draw your attention to the divergences... periods of time when the Russell is either outperforming or under-performing the S&P 500. It's also very important to be aware of what had been happening in the stock markets in general immediately prior to the development of each of the divergences. Specifically, were they rising or falling? The annotations on the charts probably tell the story about as clearly as any more dialogue so I'll simply present the charts in the sequence that I think will display the story with the greatest clarity. We begin by looking at the weekly chart which compares the price action between the Russell 2000 and the S&P over the past dozen years:

|

| WEEKLY - Russell 2000 compared to S&P 500 over the past 12 years. These are the only divergences that have occurred in the past 21 years... since the Russell was introduced. (Right click to open a larger version). Click here for a live and updated version with a closer look. |

The single most important consideration when viewing all these charts is to keep in mind what the S&P 500 (as the benchmark) is doing. Is it falling during the divergence? If so, then so is the broader NYSE and there is clearly a lot of fear in

the air. In that case, when the Russell starts to outperform there are two possible reasons for that to occur. The investment community is either becoming less and less fearful during an apparent recovery (the markets are bouncing nicely) due to spin by the media... or the market is being manipulated to give that impression. I have no doubt that it's a combination of those two factors. But do you know what? It doesn't matter what the reason is because the bottom line is that the S&P 500 (and the entire broader NYSE) are not participating in the bounce to the same degree as the high risk stocks. And the end result has always been the same.

On the other hand what does it mean when, during a divergence, the S&P 500 is the one which is rising more robustly? As seen in the only two divergences when such was the case (designated by the green arrows), the S&P 500 had been in a very solid uptrend for at least the past 3 years. In the case of 2007, the stock markets were undeniably in a major bull cycle... a cycle that was about to end. It seemed to be stretching for the stars but the higher risk Russell was having no part of it. The smart money knew what was going on. I have to assume that the exact same thing is going on today. Of course there will be those who choose to declare "this time it's different". Fair enough. Those people have every right to draw the conclusion that best suits their wishes and I'll draw the conclusion that makes the most sense. The markets have never sent a clearer message, they are running out of momentum and are signalling that they want to reverse to the downside.

The reason I wanted to show the weekly chart first was to display how important it is that we are cognizant of what was happening with the broader stock markets immediately prior to a divergence. With that in mind, we now look at the monthly chart which includes the entire lifespan of the Russell 2000. Even with this biggest of views, the view from 40,000 feet, we can clearly see that all the explanations I offered above are still applicable. For clarity, please read the annotations on this chart in the numerical sequence:

|

| MONTHLY - Russell 2000 compared to S&P 500 over the past 21 years. These are the only divergences that have occurred since the Russell 2000 was introduced. (Right click to open a larger version). |

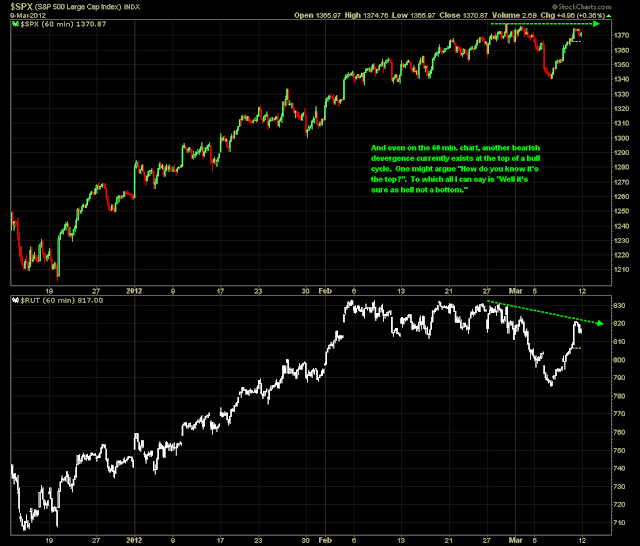

So the stage is set. Even on the grandest of scales, the same phenomenon is occurring. At the top of a bull cycle the Russell 2000 is not only lagging the S&P 500, but has yet again set up a negative divergence. On every single occasion when this phenomenon occurred the result was the same. The markets fell... without exception. And finally, we'll skip the daily chart and go directly to the 60 min. chart below, although I'll provide a link to the daily chart for those who'd care to see it.

|

| 60 Min. - Yet another neg. divergence is in place even on the micro level. This chart (and a live link to it) are ample to display what's happening on the daily time frame. But for those who feel they need to see the daily chart, it's available here. |

In the chart above we can see that once again, even on a more micro level, another negative divergence is developing where the Russell is not keeping up with the S&P which seems bound and determined to stretch the very limits and attain another local high. Unless the Russell suddenly surges with explosive force in the coming week, the negative divergence is going to be maintained. Even if the Russell were to get the Goldman Goose of the Decade award this week, the negative divergence seen in the weekly chart will still exist to such a monumental degree that it would take another 6 months to a full year of incessant liquidity inflows. The only possible way for that to occur at this stage of the game would be for the FED itself, the ECB and possibly European investors themselves to flee from European investments and throw all the money they can find at the Russell 2000. And not at the S&P 500. I suppose that's possible. But I sure don't think it's likely because if they're in that much fear they sure as hell won't be looking for high risk assets..

And in closing, I'd like to once again acknowledge Doctor_jr.'s huge contribution and inspiration for this study which I had placed on the back burner so long ago that I'd forgotten about it. Thanks for the body check doc! This one's for you:

|

| Larry Bird Claps In Applause |

I'm still expecting some 'March Madness' in the markets, myself. If not, we might have to wait until 'Sell in May and go away' gets here before we see a significant down trend. We got an early look at it a few days ago, imo.

ReplyDeleteTest post. Thanks for the heads up doc. It inspired me to write a short piece here

ReplyDeleteAR, nice post as usual. Sorry you have become fodder for trolls but I do enjoy your analysis. I have been tracking the RUT and TRAN lately and find they track each other well. Often times the Tran leading up and down moves in the RUT. Right now there seems to be so many divergences that something big is getting ready to happen. One thing is for sure, one side is very wrong. Thanks again for your analysis.

ReplyDeleteGreat post AR, check out where the RUT bounced earlier last week. That is the trendline that is going to have to be broken in order for a correction to take place.

ReplyDeletehttp://dl.dropbox.com/u/59021800/New/RUT%202012-03-11-TOS_CHARTS.png

Summer 2008 is another divergent time frame that catches my eye. Potential analog to the blue arrow period?

ReplyDeleteI was going to throw this up at rationalinsolvency.com later today, but it seems appropriate here too:

Since the November lows, on a weekly basis,$NDX is up 13 of 15$SPX is up 12 of 15$OEX is up 11 of 15$RUT is up 10 of 15$INDU is up 9 of 15

another look at divergences

http://rationalinsolvency.com/2012/03/rut031012b.png

http://rationalinsolvency.com/2012/03/djia031012b.png

http://rationalinsolvency.com/2012/03/spx031012b.png http://rationalinsolvency.com/2012/03/oex031012b.png

The S&P can't break 1380 and stay there, after numerous attempts. The DOW can't break 13,000 and stay there, after numerous attempts. If they were going any higher, they woulda already done it.

ReplyDeletePlus, none of the big timers have had the time to absorb what happened in Greece, late last week. When that many bond holders take that big a haircut, it's gotta have an impact, especially with the PIIGs -and everyone else- in pretty much the same boat.

Throw in the things you and others have been pointing out, and it's just a matter of time...not of outcomes.

(Personally, in my own circumstances, I hope things drag out for another year or two. I'm not - quite - prepared for an immediate collapse or a zombie apocalypse scenario. I need a litle more time, here.)

Would you settle for a little sub-1000 correction first so the rest of us can get out of the crazy market? ;-)

ReplyDeleteAhhhh,,,good to see a post from you Alberta' in my 2-read list this evening!

ReplyDeleteHmm, I certainly feel back in the mud-filled trenches again. Thursday was a real damaging day, I need SP'1330 to get right back into the battle with all artillery pieces firing. 40pts lower, seems a lot, but its viable over a 2 day down move.

-

I agree, from the bigger perspective, the fact R2k was flat for FOUR weeks was remarkable, and remains a clear warning. I think i said last weekend, its a case of 'chase UP over iwm 84, and chase lower under 81'.

So, I look for a break under 1340. If we get it, then the next target is 1325/20, then 1300. So many levels of resistance until around 1240/50..then freefall, if a break under 1230s.

-

First things first...Futures wheel opens in 12minutes, lets see how we open Monday. The 60min cycle is primed, and allows for 6-12 trading hours trend lower. So, bears do have the opportunity.

good wishes for the week ahead.

Excellent charts AR !

ReplyDeleteAR, the early 200 outperformance by small caps while large was rolling over was because of the massive undervaluation relative to large after years of large outperforming. Additionally, that bear market was a valuation bear market due to the Internet Bubble/Tech bubble. Small caps were actually undervalued and were actually up over the three year period, more specifically, small cap value stocks. The Russell wasn't creating any illusion. Sorry, it was simply a revaluation of asset prices.

ReplyDeleteOne more comment, divergences that are as far apart in time from each other as some of the ones you highlighted, are quite honestly, meaningless. Taking the high of last may and looking at prices today is too long a time period to use a divergence to predict an outcome. The top of 2000 and 2007 both showed divergences weeks and months prior to the top on WEEKLY charts, not nearly a year apart from each other. If you look at DPO and MACD, you will see that no such divergence is occurring on the WEEKLY charts. And to boot, MACD and DPO are at best flattening out and not rolling over or anywhere the 0 line. Sorry, but bears are only going to get a small pullback at best before this moves higher, MUCH higher. I have a short on but hope to just get a couple of percent before covering and going back fully long. GL JMO

ReplyDeleteLike I said, I need things to stumble along for another year or two, myself!

ReplyDeleteAR I just put together a quick post showing how the DJI, RUT and W5000 all bounced at trendline support last week.

ReplyDeletehttp://silversaxena.blogspot.com/2012/03/trendline-support.html

Then checkout what happened the last time such a trendline gave way last July. Perhaps it is possible this is what's coming in the next few weeks. Also note how this trendline is steeper! Cheers.

http://silversaxena.blogspot.com/2012/03/wilshire-5000-trendline-support.html

The last two years in the S&P have been a larger analog of the 2007 tops

ReplyDeleteExcellent observations AR,,,Thanks for wringing things out for us newbs. :) And a Happy Saint Patty's Day to ya.

ReplyDeleteSo markets aren't fractal then?

ReplyDeleteI like it. Where do you see us? Oct 5? Oct 9? Nov 1?

ReplyDeleteI'd feel a lot better if 1074 had gotten closer to 1010.

Warren, you sound as though you're thinking that when the market finally cracks that there will be so much immediate destruction (2007-8 only worse) that there will be no further opportunities for you to get to where you want to be financially. I don't think it's going to get so bad that the stock markets will just shut down... collapse. But I hear exactly what you're saying about needing more time. I doubt there's a bear out there who doesn't completely sympathize with that sentiment. I need more time too but I'm not worried that I only have months left to pull it all together. We have time bud.

ReplyDeleteNice charts Rob. Is that your site? If so, why don't you add a blog roll and we'll hook 'em up. Your charts are too good to not be seen by a wider audience. Thanks for another great contribution. Throw 'em up any time you like :-)

ReplyDeleteThanks TRB... you've been a good supporter and I don't even really know you... other than our recent conversations. Yay Sandpoint, lol. I don't have trouble with many trolls, just 3 or 4 real monsters. Wagner is the obvious one and the other two or three are of little consequence although one of them is worse than Wagner. In fact their methods are so incredibly alike, even to the extent that they hate Canadians, that I actually think the two worst offenders could be the same person... Mike Wagner and Tom LaCour. The only thing is that LaCour made such a big deal of the fact that he's from Texas and at first I believed him. But he also used more than a dozen different names to give himself likes and that's what Wagner does as well. In fact, those names are common to both. IOW, those names gave likes to Lacour's attacks and they give likes to Wagner's attacks. Also, both have followed me to Seeking Alpha and have done their troll business on one of the classiest websites in existence... just to get at me. So it's only those two (or maybe "one") people. I know where Wagner lives though, and it's not Texas. So I highly doubt LaCour is from Texas either. In fact when I first ran across LaCour, I was warned about him by one very high profile author who shall go unnamed.

ReplyDeleteBut I will say this... after it became apparent that I'll never be able to post freely on Danno's site again (even though he and I are theoretically on great terms... and I know he respects my work because he told me), never before have so many friends shown up and posted comments on the same day on the same post. I guess you find out who your true friends are when somebody kicks you in the balls. Don't get me wrong though... I'm very happy and very confident in my own little world. I took one very small trading loss last week and that was the first loss I've incurred since Feb. 17th. So I'm on a rrrrrrooooooolllllll and lovin' it. Too bad I won't be able to share any thoughts on Danno's, but fk it, I can sure share them here, lol. In fact, I might even get my shit really in a knot and make this site "readable" only to people who are true friends... those who go to the trouble to even register with Blogger. That would include almost everybody who has commented here, plus some who haven't. And I might get even more agitated and tighten it up even further... to only people who have registered with this blog, lol. That would be the people who you can see in the Members List at the top right hand corner of every page. I guess I'll have to check into it... but for now, don't worry about it. I'd have to get real, real angry before I'd start cutting out the viewership. One time recently I had a 1400 hits from a private site over a 24 hour period and they were all looking at the same article. I went to see who was so interested in one of the pieces I'd written, and they wouldn't even let me in... it was a password protected site. They didn't even know I was knocking on the door, lol.

That TRAN/RUT relationship is one that would never have dawned on me because right off the top of my head I can't think of any meaningful reason they should act so similarly. That doesn't mean the reason doesn't exist... just that I'm stumped as to why it is so. Thanks for that tip.

Best wishes for you too PD, you're a good dude. By the way, I just noticed that your name doesn't light up like it should when you're a blog owner. Do you have any idea why that is? People should be able to just click on your name and be taken to the latest entry on your site. That's how it works for Pretzel, Pebblewriter, myself, Chartramber, etc. Even click on Rob's name (a little further up) and you're taken to his profile (it's a hidden profile but that's beside the point). That's how it should work. I'd be pleased if you and Zimmer and anybody else who has a blog would like to get them hooked up that way. All I know is that when I created this site, it was all automatic from that day forward. Any site I visited from that day forth, my name was lit up. That's the part I'm confused about... your site is powered by Blogger as well, so it must just be a setting.

ReplyDeleteThanks CR... I think they're very revealing. And no, I don't buy into the argument that "this time it's different." I think we can safely assume that the eventual outcome will be the same as it has been for the past dozen years. The message is that the market have a severe drop looming. I'm almost as mesmerized as everybody else is, thinking a pullback is impossible. Boloney, TA is TA, and it's saying the markets will pull back. So even though the weekly charts are looking pretty darned bullish at the moment, I still have to think a pullback at least is way overdue at this stage. The technical indicators are agreeing with that notion as well I'd say. Best of success in the week ahead bud.

ReplyDeleteAR, it is indeed my new blog, I will have to get that blogroll up and going. The market is ready to roll over here, but not many truly believe it (but hey who would after this btfd mentality has lasted so long?)

ReplyDelete"One more comment, divergences that are as far apart in time from each

ReplyDeleteother as some of the ones you highlighted, are quite honestly,

meaningless."

Where does the part "quite honestly" come from? Because it's just your opinion... that doesn't make it so. You might have added... "in my opinion", because then your comment wouldn't come across as being as arrogant as it is. My opinion on those divergences is obviously very different than yours, otherwise I wouldn't haven even bothered to write this post. The main difference is that I wouldn't go so far as to utter that your opinion is "meaningless". We're running a friendly room here and it's going to remain that way.

Thanks AR, it is indeed my site, I just started using blogger so I will get that blogroll going. Does my site link to my profile now? Btw, when this thing sells off I think there is a steep correction coming, just that no one believe its!

ReplyDeleteAhh, I didn't even notice. I'm still new at this remember! Not even 3 weeks from the first time I set up my account. I added the web address to my disque profile, and indeed it now shows up. amazing!

ReplyDelete--

All recommendations always carefully assessed :)

Thanks Scotty. Yeah for sure, St. Patrick's day has always been a big day in our family for reasons that you already know. All 16 of my great great grandparents were from south Ireland (the province of Munster). We even buried my dear mother on St. Patrick's day. A fitting honor for a beautiful Irish lady who's birth name was Kathleen Murphy. And as a Scot, you're entitled to tip a few back as well, lol.

ReplyDelete..."And the Scots raised their level from 'pissed off' to 'let's get the bastards'. They don't have any other levels. [John Cleese]. LOL, I still think that's funnier than hell.

Answered above as well. You betcha... it links directly to your site now. Great job ;-) PD did the same thing about two minutes after you did, lol.

ReplyDeleteYea, but we saw on Tuesday how quick it will go when it does. When this market loses its bid it will be because of AAPL having topped out since AAPL has such a disproportionate weighting in the SPX/NDX. In other news checkout my other post made earlier today, where I said to watch silver this week. Many are still anticipating more QE from the Fed on Tuesday, however this would result in oil going up to the moon, so this will not happen. If silver has another "crash," it will undoubtedly take commodities and risk with it. The correction starts this week, but it will be truly interesting to see what happens when that trendline breaks. When it broke lost August, the SPX lost 185 points in 5 days, now that is something that I don't think anyone would believe could happen here, but this market sure looks an awful lot like April 2010. One that just keeps grinding higher on no volume until it doesn't.

ReplyDelete"Basically I've found that fundamentals tell us what should be happening and charts tell us what is happening."

ReplyDeleteThere are plenty of other ways of expressing this, but yours is an inspired one.

eh?

ReplyDeletehttp://i42.tinypic.com/16c2pmd.png

I was catching up on reading tonight. Apologies to everyone who's already seen it...but really, I imagine I'll get something out of reading it a second time:

ReplyDeletehttp://marketthoughtsandanalysis.blogspot.com/2012/02/why-i-am-not-looking-for-top-with-next.html#comment-449338600

Thanks again. For the moment, I am just focusing on trying to post at least one thing every day, if its just something really simple. Building an audience from a starting point of 0 is indeed like trying to push start an Oil tanker. Am very pleased so far though, after just 3 weeks, am listed on 3 sites (inc' yours of course!).

ReplyDeletegood wishes, I will doubtless have something later to post, after the close...even its just another 'urghh...'.

Yeah it will take time to hit the bottom. What concerns me is domino tip day -- the day the first TBTF fails. The world as we know it could completely change within 48 hours of that

ReplyDeleteIt's why I plan to get out and into cash at halfway down or sooner.

not a man given to excess humility in my experience !

ReplyDeleteWell if we need to have an exact match then I would be inclined to say we are still searching for an absolute top, although it is probably very, very close.

ReplyDeleteThat golden rodent guy used to post this chart and say never bet against it.

ReplyDeleteI made a point of finally saving it after betting against it too many times.

Thanks for the blogroll add AR, keep up the good work my friend.

ReplyDeleteHighly possible this market goes splat like that basketball when those trendlines get taken out.

ReplyDeleteWell, mostly, I need time to get my permanent plantings installed in my new edible landscape. Doing it myself, it'll take until this fall to finish things up, and another year or so before it really starts to produce enough for me and the ol' lady. Another two or three years after that for it to produce enough to barter and trade... Initially, it should save about two hundred and fifty bucks a month on the grocery bill. In a few years, it should earn us enough to help pay some or most of the household bills and trade for meat, milk, eggs and flour.

ReplyDeleteI figger the real bottom in the markets won't come along for another couple or three years.

(grapes, apples, cherries, peaches, paw-paw, persimmon, goji berries, honey berries, blackberries, raspberries, fig trees, pears, plums, apricots, blueberries, elderberries, kiwis, strawberries, asparagus, rhubarb, etc....plus, raised beds for veggies. Plus, herbs and a couple of spices with a few 'exotic' fruits and herbs planted here and there. All planted in a formally designed partition garden. When it's finished -in three or four years- almost every square inch of the property will be in production...and it will have 'curb appeal,' too.)

Yeah, I've been watching for 'tipping points' economically, socially and politically, myself.

ReplyDeleteAs you've said, when the markets begin to domino, in less than forty-eight hours, everything we think we know about the world is going to change. It'll take a while after that before things get completely out of hand, but those of us who are paying twill recognize it for what it really means.

As you've said, if we get a cascade collapse instead of a steady decline, all bets are off.

That's my feeling, too. If we haven't already topped out, we're very close to it.

ReplyDeleteWay back in the hoary mists of time, when I was young and healthy, I spent a bit of time in the ring, doing what they now call 'mixed martial arts.' I fought Scotsmen and Irishmen a time or two... I never lost to them, but I always hated to fight them. They made me work for it...and it always hurt.

ReplyDelete'Ding, ding, ding...'

...and as I headed for the center of the ring: "Damn. This is gonna hurt..."

Nice post, AR. Thanks for the good info!

ReplyDeleteHere's what it looks like over a year. And the second one is about the same time frame as the chart you posted: And yes, these are my charts. I was experimenting with the "Mohave" chart style and just found it too much work to change all my charts over to that color, lol.

ReplyDeleteThanks Dave. It's not a popular revelation to those who insist on the uber-bullish scenario but I can't help but to think that its message is pretty clear. On the other hand, at this stage the FED even has me damned near convinced that we're going to see 1500 on the S&P.

ReplyDeleteThat actually sounds very exciting. I've always had a real knack for growing veggies and gardening in general. I used to grow veggies in raised beds and the advantages of that style are just too numerous to mention. Incredible production out of each square foot. In fact there used to be a TV show called Square Foot Gardening that got me started on it. I still have the book around here somewhere.

ReplyDeleteLOL. My mother's brother, Jimmy Murphy boxed in Detroit as a kid. He won 29 straight fights and then lost his last one. He hung 'em up after that loss and lived to a ripe old age. What a great guy he was. Funnier than hell.

ReplyDeletehe's been at the mescalin again

ReplyDeleteSo you're aware of the benefits of peyote? That's good. Now all we have to do is find some and mail it to Zimmer. Can you imagine what his charts would look like then?

ReplyDeleteMaybe something like the Holy Grail chart?

ReplyDeleteRandom post, but with the VIX collapse earlier this morning and subsequent rebound, it did hit long-term support, which is a positive given that SPX has yet to mount 1378.

ReplyDeletehttp://dl.dropbox.com/u/59021800/New/VIX%20LT%20Support%202012-03-12-TOS_CHARTS.png

Point being, there's no such a thing as a 'risk free' environment. Sometimes, if ya wanta win, you gotta take yer lumps.

ReplyDeleteFeel free to call me Lumpy then, lol.

ReplyDeleteI think the surest evidence that markets are not reflecting true social mood waves is the lack of retail investor participation.

ReplyDeleteThe game plan as I understand it was pretty simple: Give troubled TBTF banks free loans to buy equities with. Let them run the market up high enough to draw in retail investors, then unload the stuff they bought on those retail investors and keep 100% of the profit.

Unfortunately changing what's written on the scoreboard does not change the actual score. The market may be printing a ticker that says everything is looking great, but retail ain't feelin' it and they ain't buyin' it. (That's why I think the downturn in social mood is actually well underway.)

And now the big fins own 30% of the market and they gots nobody to unload it to except each other -- the slowest one of them to the exit door gets a big bag to hold.

And if they were counting on all that profit to solve a bunch of the other issues, and it vanishes, the first really big domino might get tipped.

They'll find some one papa...they always do. How bout them foreigners ?

ReplyDeleteYou make an interesting point, though. It might take the fins more time to

lay off their equity positions than it usually does.

If they are going to screw with the retail investor wouldn't it be the bond market ?

I love that every time I see it, but I don't think there's any number of mail packages that'd help me transcend into that level of consciousness.

ReplyDelete...but when should I expect the delivery? :)

From what I've read, options is where the focus has been.

ReplyDeleteLooking for the Extreme Point Rule to trigger tomorrow after the VIX closed outside it's lower Bollinger Band today...

ReplyDeleteword

ReplyDeleteVery good summary ... yes, the banks need an exit plan for all the equities they bought ... maybe that argues for a longer topping process than we'd normally expect. IBD says most tops are 3-4 months. But P2's might be shorter than other topping waves.

ReplyDeleteExcellent observations Monsieur Rocks D'Alberta! Nice proxy for risk-on ... the small caps!

ReplyDeleteAnd it's a clearer sign than most things out there ...thanks.

YAY! SHABS!!

ReplyDeleteIt's good to hear your voice man. Don't be a stranger.

I think so Greg. It's about as basic as we can get I think, to compare the higher cap S&P with the smaller cap Russell. And the movements between the two are very meaningful. So I'm very confident that the divergences we're seeing on so many levels are very telling. Of course it doesn't tell us that the markets are about to head lower at 2:34 p.m. on Wednesday or anything even remotely specific like that, but I just can't ignore a message that's as clear and dependable as what I've outlined. Others may argue that it's useless if they like. Well, one person already did. But I'm stickin' to my guns on this one.

ReplyDeletePortfolio insurance !

ReplyDeleteI guess you saw where Apple is, in market cap, practically tied with the entire US retail sector. Not a bubble, right?

ReplyDeleteIt's almost tied with Spain.

ReplyDeleteThat just means the entire US retail sector is undervalued. :-)

ReplyDeleteWalter Murphy was just on BNN and his opinion is that the markets are headed for a correction but probably just a correction. I've been a fan of Murphy for a long time. He's a very sharp guy and he's just going by what the charts are telling him. So maybe we should look at the action in the next few weeks to a month as being just a correction and perhaps even swallow our pride and go long? If the pattern tells us that's what we should do, then I'm just going to forget about the credit crises in Europe. Apparently there isn't one. Or at least, if there is one, the central banks are just going to keep printing and printing and printing until there isn't one. Equities to the moon and gold to Jupiter. Why not? It's become clear that that's what the central bankers are going to do.

ReplyDeleteOf course if the next correction is a whopper, an impulse, then I'll most likely forget that notion. But god damn it, this market just refuses to go down and that's no "glitch". That's a concerted effort by those who pull the strings. It's starting to become clear to me that they're just going to do whatever they want to do with impunity. The world is facing the biggest credit crisis in the history of the universe and the markets are just shrugging it off as if it doesn't even exist. WTF?

In any case, here's that interview with Murphy:

http://watch.bnn.ca/commodities-report/october-2008/commodities-october-3-2008/#clip636810

Does SPX 450 count as a correction? :-)

ReplyDeleteI guess I just look at "Investment Advisors" on TV as someone selling their book, nothing more. That's not to say they're wrong, but they do have a vested interest in YOU getting in after them.

There's just so much artifical liquidity you can push into the system before you need actual fundamentals to provide true growth. If the Fed is true to their mandate (stable price and full employment), they will be unable to justify QE3 based on the current round of "good" economic news being spun by the administration and the media.

The US market is at a new multi-year high but is still 2 million jobs in the hole from the start with 4 million mortgages currently in default. And don't get me started on Greece, it's in a worse financial position after this bailout than it was going in!

If I end up on the long side, it'll be for minutes at a time, rarely hours, and never days. In the meantime, I get the prospect of another 4 years of Obama, Greece dwarfing deficits, and exponentially more people on public assistance as the poperty line rises with the market. I guess it's "Welcome to Black Camelot"...

Sorry Zim, I missed your comment until now. You mean you haven't received the package yet? You know what buddy? I'm starting to have some real longing feelings right about now.

ReplyDeleteThey have to turn the faucet off every now and then. There are consequences if it runs all the time. Like higher grocery bills.

ReplyDeleteCheck it out.

ReplyDeletehttp://en.m.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)

So AAPL is as big as Switzerland. I just shake my head and wonder what planet I'm living on.

ReplyDeleteIf this is an exhaustion in AAPL, and it turns out like silver/gold of last year, look out below!

ReplyDeletehttp://silversaxena.blogspot.com/2012/03/blowoff-top-wedge-overthrows.html

Nice charts Rob. You might also note that the pub is catching on and you can always post a link to your charts there as well. You might get a bit more exposure there if the pub keeps growing as readers get used to the fact that it's there for a purpose. In fact, feel free to copy and paste your comment above over there too if you like.

ReplyDeleteThanks AR. Completely agree AAPL's weightings in the indices are so disproportionate that when it falls it will shake everything else out of the tree with it.

ReplyDeleteYup! Including the nuts. lol

ReplyDeleteMy comments were not about fundamentals rather why the technicals behaved the way they did and why there was no conclusion to draw from the "divergence" as you had suggested in the post. It wasn't all that different to when the nifty 50 bubble burst and large underperformed for years relative to small during that bear market. Paying attention the a divergence between small and large can simply lead to coincidental conclusions, if that makes sense.

ReplyDeleteAR,

ReplyDeleteI have noticed, and I mean this respectfully, that you are extremely sensitive. Quite honestly is just a saying and maybe from a grammar standpoint it was not the correct term. I can't apologize for not having perfect grammar. There was no intent at disrespect. As far as the "meaningless" comments, I said nowhere that your opinion was meaningless, rather simple stating that a divergence that goes back so far is a meaningless data point. You might disagree with the comment, but when one writes it is often opinion, which may be fact but unless evidence is shared must be taken as opinion. I don't think that every time a person shares an opinion, they must state that it is their opinion. If that is your nature and you find observations about technicals (not you as a person) to be attacks or disrespectful than I will take my opinions, posts and observations elsewhere. That is ok with me and no hard feelings. I am from New York originally and you are from Canada (I believe). Maybe it is a cultural divided that will not be bridged and I am best chatting on other boards. Best of luck to you and your investing.

In other words you're of the opinion that it's kind of like comparing apples to oranges and that there really isn't a relationship? I think what you're saying is that if it were to evolve that equities fell from here, it was a coincidence and nothing more. Perhaps you're right.

ReplyDeleteHi valunvstr. I will admit to being very sensitive about certain things in life. When it comes to decency, politeness and respect for others there's a certain level that when crossed, quickly leads to more of the same. Please consider this example: My background is in construction and as a site superintendent in charge of a large high rise project for example, one of my absolute demands was that the subtrades clean up after themselves on a regular basis. The reason for that insistence was that I quickly discovered that if you let the men treat the site as a garbage dump for even a day, it will literally become a garbage dump overnight. And will remain one for as long as you let it happen. I've discovered that the same concept applies to websites. You know what I'm talking about.

ReplyDeleteSo I'll apologize to you for coming across as a bit of a hard case. I'm actually not. I'm a pretty darned easy going guy with one wicked sense of humor... a sense of humor that gets in my way every day of my life. My daughter had always warned me about being very careful not to assume any particular connotation when reading text from others. Not to make assumptions that might be a misconstruing of what the writer of that comment meant. I will admit to having a fast temper when I feel that I (or even one of my friends) is being attacked. I'm that way in real life as well. "Might as well nip this in the bud" is more or less how I've always operated, lol. But seriously, I'm a good guy, easy going, easy to love friends.

"Maybe it is a cultural divide that will not be bridged and I am best chatting on other boards."

I assure you with 100% certainty, that that is a huge part of it. The American and Canadian cultures are so different you wouldn't believe it. The level of politeness and methods of interacting with strangers in the US is so different than in Canada that I find it absolutely shocking to be quite honest. They are very much two different worlds. I've noted before that it's entirely possible that I've been spoiled by the culture I live in and that it isn't realistic for me to expect that the manners displayed by others, the degree of friendliness, reluctance to offend others, etc., to be the same in all other countries as it is where I live. In many countries it is precisely the same. New Zealand is just one great example But in other countries it isn't. I don't handle impoliteness well at all, but I admit that I have to be very careful not to misread impoliteness and most importantly arrogance, when in fact they aren't really there. Or at least, not intended.

There will be many people who choose not to comment on this site for various reasons. And there is also a group of people who understand me perfectly well and are in full understanding and agreement with the reasons why I get pissed off. They will continue to be great friends and will continue to share their charts, opinions and humor with me for a long time to come. Those are the kind of people I want in my life. It'll all work out in the wash.

Best of luck to you and your investing as well.

AR, always overly polite.

ReplyDelete1. No. And I am suffering.

2. Did I say no?

Here's where the response bursts into uncontrollable song. It's like a Broadway musical, but without any shame about literal copycatting.

You've got...

That lovin' feelin'...

Oh Oh that Lovin' Feelin'...

You've got, that lovin'

Feelin'

Now it's gone

Gone

gone

...gone...

O-o-a-oh

There is not impulsiveness to this. Look for the fives and threes. That's my story, but I'm not about to stick to anything. But's not f'n impulsive. Goose died for it, for Iceman's sake. I've heard Maverick was always partial to Gann.

Higher prices do not mean a healthier market.

But maybe I've just been at the mescalin again...

Have you ever noticed how charts like that, particularly that one, have an effect of almost making the chart appear as having depth? 3D. When I look at that chart I almost get the sense that I'm seeing it in a different dimension... as though the candles on the chart are not only moving toward the 'right' on the page, but also coming toward me. Can you see that too? Or should I get back on my meds?

ReplyDelete