Had those couple of nincompoops (Disparaging? Maybe a bit... they're trolls which makes it ok lol) employed the common courtesy of at least reading that article before running off and screaming with their hair all aflame that one writer (who is perhaps known for having bearish leanings from time to time) had suddenly "gone long at the top", they would have understood what I was seeing that was causing such tormenting conflicts about the markets. Those people had better read this piece a bit more carefully too because at the end of it there's going to be a quiz. In any event, had they read that article instead of pretending to have read it, they'd have discovered why there was such anguish in seeing so many signals that appeared to be bullish at a time when there were also several signals that were in direct conflict. I also went on record as saying "Of course I reserve the right to change my mind but unless we see Monday's (April 23) low of 1358.79 get taken out, I'm going to assume we're heading higher." But contrary to those bullish signals of two weeks ago, that 1358 level has been taken out and those signals have since turned lower. What a difference a week makes.

Let's face it, calling market tops is a tough gig because while markets tend to want to tire naturally and cyclically, there are powers that be who have no interest in letting the markets drop at all. As the old wisdom goes, "market tops are a process, bottoms are an event". So it stands to reason that during the slow rolling over phase it's not really out of the ordinary at all for various indicators to get out of sync as they too begin to enter the transition phase, one at a time. But of course when the trend in equities is on a roll, it begs the questions "Why try to call the tops at all? Why don't we just recognize the larger trend and simply go with the flow?" Because there comes a day when various measures begin to indicate that although the market trend is indeed still 'up'... it shouldn't be.

The day eventually arrives, as it always does, when the markets get to the point that by all rights they literally should be taking a much needed breather but refuse to do so... instead just continually extending gains or beginning to head sideways in what appears to be a consolidation with a bullish bent for weeks on end. As we all know, corrections are healthy and normal. In fact they're as normal as say... well, farting. But when the power brokers possess the corks and know exactly how to insert those stopgap measures so forcefully so as to completely alter the natural flow of normal everyday fluid dynamics, they're just delaying the inevitable and invariably setting up a final result sure to be more violent and unnecessary than would have otherwise been the case. More often than not when the manipulators push the limits to such incredible extremes as seen in the markets today, the result is sure to be... well what would one call it... uh... a bit of a shitstorm. Please excuse my language but that particular word just seems so darned appropriate to describe something that now appears to lie dead ahead that none of us wants to deal with... courtesy of central planning. Who in their right mind would want to, or would even dare to stay long when the markets have gotten so abnormally, artificially and dangerously bloated like they are today? Especially in the face of new developments and new bearish signals such as those shown in the chart below? I guess it depends!

The efforts that the power brokers have gone to in order to delay the inevitable are unprecedented. They have been able to pull off the near-impossible... to hold Wylie Coyote suspended aloft while he awaits his certain doom. Then calmly, they just slide the entire cliff over ten feet and our friend Wylie lands firmly on his feet to live another day and ponder the question "Why in hell am I not dead right now?" Needless to say, this type of horribly dangerous market interference just isn't normal or healthy. It's downright destructive in the long haul and scary as hell. But when we get valuable signals like those seen in the chart below we should consider ourselves very fortunate to have been so warned. In no way am I saying the markets couldn't still head higher. It's just that the indications on the chart below are saying "not any time soon buddy".

I'll just present one chart... a daily chart of the S&P 500 with 3 critically important and very informative market internals measures, each in their own separate panel. All 3 are finally in sync not only with each other but with the market as well:

|

| SPX Daily as seen through the eyes of 3 different types of market internals measures. Click here for a live and updating version. |

I'm not even going to bother to go into detail about 'why' those indicators are so bearish, not even going to talk about the divergences nor the fact that for the first time in a very long time, not only are they now putting in a lower low, but are getting confirmation from a lower low in equities as well. When was the last time we saw that happen? The annotations on the charts should be sufficient to get the point across.

Just to make it clear, all three of these market internals metrics have recently turned decidedly bearish. Two weeks ago that was a different story. With the bounce off the April lows, those same indicators had suddenly flipped slightly higher and that of course threw an entirely different (and newly bullish) metric into the mix. Admittedly, in theory those indicators can just as easily flip right back up yet again and become bullish one more time. Another $trillion might do the trick. But without further stimulus, as irrational and toxic as QE is, those indicators are likely to continue lower. How could the markets possibly be turning bullish again while the world is currently undergoing the most deflationary events in the history of mankind (not to mention the threats of so many more to come). On top of that, how could we take it seriously when those indicators were turning higher two weeks ago in spite of the fact that many of the larger moving averages were indicating a bearish scenario was unfolding? That's what I was struggling with... the market internals were tuning bullish but other indications were that the larger trend had turned down. That's a great way to get a headache. Another is to have a beer with my neighbor when his wife is home.

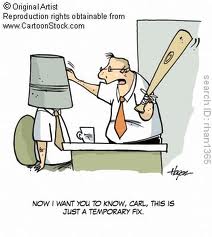

|

| When logic no longer exists |

So we await the market action over the next week to ten days and see what transpires. But with the internals heading lower like we're seeing in the chart above... equities ain't going any higher with conviction. They can't, not as long as those indicators are breaking down. They would have to turn higher and are clearly not in the mood to do so at this time. And until they do... a bounce to perhaps 1380 is about all we should expect.

Thanks for taking the time to read and now for the quiz: Don't bite the hand that ________ (answer below)

Best of luck with your trading and until next time...

Answer to today's quiz... "has just wiped your arse".

=======================================END OF ARTICLE =====================================

Mark Faber sees 1987 style crash on the horizon:

.

Nice post AR.

ReplyDeleteInternals wise, we do have some little blue lines in play (or nearly so...wanna see what it looks loike tonoight) today....at price level support (1341) as well....

May 4

Today

Covered all shorts. Wanna see this.

ReplyDeleteThanks AR! Looks like it is all shaping up nicely to go down.

ReplyDeletePerhpas a few of you fellas can give me some input? Penson is going to be delisted from NASDAQ and its current stock price is .40. A few blog spots are saying it's going BK. Im getting my brokerage account out today, and that of a family member who is disabled.

Do you have a brokerage house you like and "trust?' I stopped by Schwab as they have a local office here.

Or perhaps I should just take the hint and foget trading and safeguard cash?

Do they ALL re-hypothecate?

Nice. How do you prepare that link SJ? With Paint or some such editor?

ReplyDeleteWords

ReplyDeletePut the link inside the first quotes in that code above, and put the words where it says words. Yay!

You're welcome DL and yes I'd say it's set up for lower prices. A little bounce wouldn't be out of line at all but I'd guess that it should be limited to about 805 on the Russell. I know you watch that one. You might also get hooked up with Pretzel and read his posts. They're absolutely outstanding on every level and he's a good friend of this blog. A true gentleman with a sense of humor, living in a Hawaiin paradise and and who protects his contributors from the nonsense we see on another site... just as I do. My kind of guy. Here's his latest contribution.

ReplyDeleteSorry I can't help you with your questions about brokerages since I am not in the least bit familiar with American brokers.

LOL... no dude... I know how to add links. I mean how did you prepare the "picture" of your comment. HAHA. Yer funny.

ReplyDeleteOH, sorry, that is just take a picture with jing and upload into my photobucket. How I do all my charts and pics...

ReplyDelete<a href="http://s835.photobucket.com/albums/zz279/SoulJester/>SJ Photobucket</a>

Like This

ReplyDeleteGotcha. I take a screenshot and than cut the piece I want with Paint. By the way I've got one hell of a fast and handy little screenshot taker. I can provide a link if you want a real handy one that just hangs around down there by your clock until you need it.

ReplyDelete(MarketWatch) — Contrarians believe that a correction in excess of 10% is unlikely anytime soon.

ReplyDeletehttp://www.marketwatch.com/story/major-correction-unlikely-2012-05-09?dist=beforebell

Worth a read.

AR - great post, thanks for your effort. Writing one of these takes a lot of time, and it is appreciated.

ReplyDeleteThanks Al... glad you liked it. In all honesty though, once I have it clear in my head what it is that I want to say, I knock something like that out in no time at all. I really should take more time with them because they could certainly be refined. I fear I might be developing some bad writing habits all in the name of "just write your thoughts down and and get it out there". If I ever do write a book I'll certainly have to spend more time structuring it properly and just 'refining' the whole package. Don't even know if I'm capable but one of these days I'm going to look up Jeff Buick and meet him for lunch or something. Just for a chat.

ReplyDeleteHi DL. I know that office, and it's a good one. Very professional, etc. Only thing is Schwab isn't a great trading platform (decent fundamental research access, though -- used to offer Goldman, not sure now). I happen to like TOS by TD Ameritrade... but zero local presence where you are. They do, however, link to your bank account and service has been very good unless the market is melting up/down.

ReplyDeleteGonna scalp AUD/USD long here off that moring low pivot arear...just see what's up....just an indicator setup nothing I trust...

ReplyDeleteNice post, AR. People who quote you without reading all the way through deserve to be on the wrong side of the trade :-)

ReplyDeleteFWIW, I think you're on the right track. I see a little H&S possibly setting up on the right shoulder of the larger pattern. It would be nicely formed at 1370ish, shake out a few bears, then get out of the way for the larger pattern to play out (1295-1317.)

After that, I'm afraid I see a decent chance at 1462-1472. Then again, my thinking is a little off since the last time I donned a bucket and offered 3 swings for $1.

Cheers

SPX's Little Blue Line will be at about 1381 tomorrow, which is in the arear of the 200 sma on the 15 minute chart.

ReplyDeleteRoger. Will give ya a hollar if Jing ever goes south on me.

ReplyDeleteTbone just posted chart with that target. Looks roight to me iffin we are still doing the May 14 is low thing..

ReplyDeleteConsidering the monthly cycle now, I just can't see how we could possibly go back above 1395/1400, unless Benny does QE3 now - and as I keep stating to people, the Fed NEVER pre-empts a looming down cycle.

ReplyDelete-

As listed below, just a simple SP monthly chart. No fancy stuff on that....how can anyone be bullish now? We are rolling over, with the first target being the 10MA of 1294 - although I am looking for the 200 day MA of 1276.

-

hey AR. I had a rather roller coaster day in the bunker..I wake up...and see a bloody red screen! Urghh...a Permabear going long...the humanity! Or is that 'Bearity; ? So...I bailed like a rat on the Titanic at 2.30pm - I was watching the 15min cycle..managed to get out with a green exit...now i sit all cash.

ReplyDeleteI'm still looking to go long again tomorrow morning (urghhhhh). Futures are looking red again. I think its even possible we hit 1340 tomorrow...but I hope not.

We should see a little move to 1375/80 still.

-

I sure still looking to go max-short around 1370+ though, ALL the bigger cycles - including those fancy indicators your chart highlighted are now bearish. I'm shorting this nonsense all the way to 1270..or lower.

Good wishes!

That weekly channel line in USDJPY that we pinged this morning is also the 200 sma on the daily, fwiw....just noticed that..

ReplyDeleteahhh those Canadian proverbs....such folksy wisdom :-)

ReplyDeleteHola Steenky. But that 'wisdom' just makes sense does it not? Much like the admonition to "never pet a burning dog". I mean some things make sense and some don't. I think those proverbs make good sense. You should mind them in my humble opinion. Hope you're having a great week bud.

ReplyDeleteNobody really talks about how structure off the October low is broken any more...From March...the 2012 count. Still gotta trade it cause it is just EW. Watching the June and October time confluences for the big picture...

ReplyDeletehttp://i835.photobucket.com/albums/zz279/SoulJester/Bigger_picture.png

http://i835.photobucket.com/albums/zz279/SoulJester/THE_2012_COUNT.png

Big candle up on the hourly here.

ReplyDeleteAhh, thanks for that ... maybe THAT's where it wants to find support. I just noticed that 79 would be 5/8 pull back (76 to 84) ... that might be a target. And also the high of that first surge in the yen (wave 1) was in the mid 79's That could have been a good target.

ReplyDeleteAAPL doesn't seem like it's being sold heavily these past 2 weeks.

ReplyDeleteLow volume doesn't look implulsive yet.

All it's done is close the gap from earnings day.

And no real sellers anymore.

Which makes me think we're not at a real bearish moment yet.

Not sure what the count is ... thought is could be 1-2, i-ii on AAPL. But it has to break this level for a lower low.

Nicely done! That AUDUSD has me befuddled ... but Greenface had a nice count on that wabbit.

ReplyDeleteLooks like it's a wave up away from a huge puke ... 3 of 3 I think ...

That's pretty much what I'm thinking too Pebble. I was envisioning something like 1380 on SPX and 805 on IWM. If I was a gambling man I'd also guess that those shoulders will develop by Friday which of course also happens to be weekly options expiry. And max.pain is higher as well at $139 for SPY and $81 for IWM (which would equate to about 810 $RUT) and $66 for the QQQ. It would take a heck of a burst to hit those targets but I'd say that at least that's the direction the market will want to head over the next 40 hours.

ReplyDeleteGawd... that AAPL is getting to become a wee bit of a mystery isn't it Greg? You're so right about that volume, it's been remarkably low since that April 25 peak. The moving averages on a daily chart are suggesting a new bearish phase is probably here but I'm sure having a difficult time buying that idea because of those very volume measures you mention. I don't even have any valid reason to just assume that the April 10th peak was "the" top. Maybe we're in a 4th wave with higher prices to come, like maybe $700? If I didn't suspect that the entire market was going to head lower I'd look at that AAPL chart as it stands tonight and could think "Sure, why not? AAPL to $700 looks reasonable." The $550 level looks so key now.

ReplyDeleteHey AR, yep found Geno posting on Daneric’s board. According to his short

ReplyDeleteterm outlook we are both on the same page along with Tony Caldaro, buying

the wave C of 4 bottom. Still long TZA from last week but looking to swing into

longs anytime now.

US markets sell off at the open, remain under pressure, then recover somewhat

ReplyDeletelater in the day. Been going on like this day after day for sometime

now. European fund managers are selling their US holdings to raise cash to meet

fund redemptions. Once the European fund managers knock off for the day buyers

step in. Notice though how US markets are holding up better than the European

markets, a sign of underlying strength. Pay attention to the FTSE and Dax. Both

display better bottoming indicators to look for a bottom. Once they bottom and

turn, US markets will soar. Breadth divergences are blatantly obvious now.

Hey AR...to answer your question from earlier today...control by twisted individuals is the short answer.

ReplyDeleteJust in case you haven't seen it...

http://www.youtube.com/watch?v=mRWZoCqnDhE

Hey AR, thought I'd sign up to disqus, do things more proper. Guess this means you'll be seeing me around more often! Additional passing thoughts. SPX weekly DMI continues to be positive but the gap is closing.. Thinking May 16-18 for a low or out to May 25.. time for some positive divergences to show up.. In this case I'm thinking a larger three wave move up followed by another wave down to put in the final trading cycle low.

ReplyDeletehttp://rationalinsolvency.com/2012/05/muppetbait.png

ReplyDeletehttp://rationalinsolvency.com/2012/05/spx051012m1.png

Any news behind this morning's big spike up in the USDJPY? Almost made it back to 80!

ReplyDeleteI wish Gerald Celente would do one about good ol' Jon C.

ReplyDeleteHey Chairman! Well at least now you can participate on any site that uses Disqus as the comment handling system and you can log in quickly and be recognized on all of 'em. Probably a good idea.

ReplyDeleteGeez... with all this choppy action over the past 5 days with the market basically going nowhere, I'm not sure what its plans are for the rest of the week. Or next week. HAHA... as if I was ever sure. LMAO... that's a good one!

I think this weekly channel/200 sma/61.8 fib arear that we have been talking about could very well be the bottom in USD/JPY. FWIW....I have bullish harmonics now firing on the 8 hour. So bottom is in or one more little is my thought. I am not covering shit. We are a little over 2 trading days from May 14. GLD hourly Fisher/ADX is in a position where we either bottom or we have another low that eeks down with a declining ADX to finish the move. All IMHO.

ReplyDeleteImma gonna take a long look this weekend at the notion of going long equities on Monday. May 14 was the plan, anyway. Question I have is will the June low be a higher low or a lower low.

ReplyDeleteBearish little blue line still in tact roight now at 1381.

Yes really choppy last few days, very difficult to dissect. I do know that action up from yesterday's low in ES is very much corrective to this point, so on that basis should be more downside coming.

ReplyDeleteSure looks that way although I'm still suspicious that there will be a runup into tomorrow's close. IOW I still think we might have seen the SPX complete an 'abc', then an 'x' and now a fiver up to complete the larger 'abc'. Sorry I don't have time to put that on a chart. Bottom line is that I still have a hunch the market is going to shoot for about 1380 before heading lower. But for sure, this mess we're in reminds me of the Vomit Comet at the fair.

ReplyDeleteIn the ES I've got a 5 wave count down from the May 1 high into yesterday's low, but since then it's been so choppy that it's difficult to put a count on it with any confidence. So more time needed for things to unfold before labeling things.

ReplyDeleteOff to Washington (Yakima & Wenatchee) next Wed - Fri, I'll wave at you from the plane window when we pass your longitude lol. Severe scarcity developing in the apple business, going out there to work on supply - next season looks even worse, major apple crop failure in eastern half of the U.S.

Thanks Al. I was thinking a little more along these lines.

ReplyDeleteMy mother had an uncle (a Canadian) who lived in Walla Walla, Wash. He

used to come up to visit us when I was a tyke and he always brought us

boxes of good apples. I'll always remember how brown (tanned) his arms

were, lol.

Many years ago, when I was 20 I went down there to Washington to visit my brother who was attending Gonzaga University. I passed through Wenatchee and was really impressed with the big size of the coulees around there. Similar to the type of land on each side of the river around Lethbridge where I was raised. But HOT... holy shyte I nearly died. I think the temp. was about 100.

I was alone and just accidentally ran into some Americans when I stopped into a pub for a cooler. They invited me to a big shin-dig outdoor kegger/drunk party somewhere out in the wilderness (near a river I think) and I was just crazy enough that I went. I could have been murdered, beaten, robbed... anything. But the next thing I knew I was waking up in my car the next morning not even knowing what state I was in... other than the state of confusion. Every soul was gone but me. But all my parts were there. All my money was on me and apparently I had a good time. But I never did see any of those people again to ask them if I had a good time or not, lol. I wanted to thank them for not beating the hell out of me... after all I wasn't an American and they knew it, lol. They were good people.

I'm figuring after all this chop we get one last wave down from the 5/1 high making 9 waves in total, to complete all of wave C of 4, bullish count. The 60min & 120min Stoch appears to want this one final dip to oversold for the pivot. If this happens it'd tie in with SJ's 5/14 for a low.. its a wait and see what happens.

ReplyDeleteSo what are you thinking SJ, that maybe the S&P is just finishing of a wave 4? Entirely possible.

ReplyDeleteGood to hear SJ. This is also the beginning of a new 13-week cycle in the USDJPY which means it allegedly according to that indicator, fwiw, should not end lower than last week. And it had a nice 7 week correction to those three areas you mentioned.

ReplyDeleteNice post AR with Marc Faber saying chances of a 1987 style crash are growing.

ReplyDeleteBecause many stocks have already rolled over.

Earnings outlook is weakening ... SP companies have 50% exposure to Europe and ROW.

And India and China are 2.3B people, and those markets matter most, and are slowing massively.

In comparison, Greece is irrelevant.

What a miserable shit show the market has become for the past week. I think it's getting very dangerous here:

ReplyDeletehttp://stockcharts.com/h-sc/ui?s=IWM&p=15&b=3&g=0&id=t78739989452&a=261233800&r=1336674158447&cmd=print

Thanks Greg. Sorry, but I took that video down. It's available on ZH anyway. I was just experimenting with "embedding" videos and I had to do it from the HTML editing page. I'm not very familiar with that language and it spooked me a bit. I didn't even see how to center the video. So I just removed it until I've got time to learn a bit more about HTML.

ReplyDeleteBut yeah, Faber paints a pretty scary picture. Basically unless we get a massive QE, he thinks the markets are headed down the tubes. Flipside of that coin is that "if we get a massive tanking in the markets 'then' we 'might' get more QE". But by that time it's too late to save the markets I think. It might provide a bounce and that's about it.

I dunno Chairman... after what I've seen today I'm starting to believe the market is getting exceedingly dangerous right about here.

ReplyDeleteMan... did anybody else hear that pin drop?

ReplyDeleteI am thinking I am going to take a hard look at going long this weekend on the 14th. I planned to as a swing. Basically, I do not know if the early June low will be a lower low or a higher low. So, when I planned out the June swoon NYMO trade, I planned that worst bear case (i.e., the bull case), was for a save at the 1341 arear. So, this is possibly bullish. Only the sands of toime know. I need to see what happens after the move up as that wave iv is in play (1511 by October).

ReplyDeleteI am not getting involved here equity wise until May 14 (planned that after the cover yesterday). To many currents here for me and willing to miss a move as catching a fair piece of it is all I am concerned aboot.

So, I think we close at 1381 tomorrow, perhaps, and go down into Monday for a lower low. But, I don't have a shit ton of confidence in that to play it either fashion.

Basically, gonna ponder the buy over the weekend and plan it out a bit. June should be the better buy even if it is higher (pivot and all) I think and that is what I want to think abooot.

Thanks. Wish I could help ya out but I haven't got a clue where this pig is going... other than that with 50 minutes to go it's starting to look pretty darned scary to me.

ReplyDeleteThanks for that GB!

ReplyDeleteRoger. Nobody does. Trend is still down. So, I dunno. Probably should have held onto the runner position, but don't really care here that much...

ReplyDeleteI didn't do any intraday equity stuff this week. Was just looking and the 30 minute Opening Range break was solid all week (with one mid-day reversal)...just fwiw in case anybody here is playing smaller moves...

ReplyDeleteWe either got 5 waves up off yesterday's bottom in USDJPY or 5 of 3.

ReplyDeleteNice call.

Thanks! I owe ya an answer on that indicator question. Was going to write something up more but haven't had time. Short answer is I use indicators largely to stay patient, but that Fisher ADX setup (with a 5/3/5 stoch as the cross) is really awesome. I happened across it just experimenting to find something that smoothed some things out. As far as I know I am the only person who uses it (apart from Dog). I really like the Fisher. Not many platforms carry it. My sma things (26/39/78) is really just an indicator anyway as most of the standard indicators are just glorified moving averages. Anyway, fire questions away. Big thing on it is just go back and look at it and watch how it acts on corrections and 5th waves. I don't understand the math behind the Fisher except to say I read it and it is pretty neat sounding, lol. I spent a lot of time without any indicators just using pivots, fibs, and smas. My main fx chart has no indicators (no fisher so no indicator). The other one I like is the DMI because it works with candle entries, which I use with bands and envelopes. Anyway, short answer, but if you spend time looking at that Fisher/ADX thing it is pretty kewl with lots of information in it (that was the short term indicator--hourly-- I hit last night off the low in AUD/USD).....

ReplyDeleteSo if you find out something interesting about the fisher in your reading, would be uber interested....

ReplyDeleteMan alive did I get lucky it seems. It looks like I might have made all the right moves today judging by the bombshell out of JPM. Futures are heading south fast.

ReplyDeleteI had super cheap call options going that expire tomorrow. Didn't like the shape of today's action so I sold 'em all for a very disappointing profit of 11%. Was looking for a triple. Better than the loss though that I was sure to suffer if this chart was right. So I dumped those high risk options and went short with puts with an hour to go in the day. Barring some miraculous turnaround in the futures those positions should pay off handsomely. Judging by the "risk off" action in the currencies I doubt there will be any miraculous upswing in the futures. Mostly in cash so it's no great risk either way.

Riddle: What is the best way to trade this chart????

ReplyDeletehttp://i835.photobucket.com/albums/zz279/SoulJester/R2k-2.png

yeah...riding Dax and Ftse shorts and trying to ignore the noise !

ReplyDeleteWell based on what the futures are doing right now it look to me like the H&S neckline is going to be broken tomorrow. So I'd say that if puts aren't outrageously expensive tomorrow morning on IWM... buy some puts.

ReplyDeleteI think the game is about to shift into second gear. That JPM bombshell was like pulling back the curtain. Financials were down hard in the second half of today as it was. They closed higher but after giving up huge gains and they're getting hammered after hours.

ReplyDeleteNo time to post a chart. NZDJPY that is the fractal. August 2011 for a touch of the 78 daily. Jives with the cycle dates as well. (61.8 arear in 2011).

ReplyDeleteDon't forget to send a thank you note to JPM...

ReplyDeleteHere is the rough draft of the scenario I am pondering this weekend

ReplyDeleteProbably jives with an August bottom and another in October. IF this is P3 or something like that, we blow out the bottom of these envelopes. IF not, tracking the 2011 sell, this is a bounce arear both regression and fibonacci. So, just a throwing it out there, still a pondering. The daily risk chart is bearish as you can see with 50 now crossing the 78. Use what you like, these are just the smas I use on all time frames. Doesn't matter if you know how the smas dance. We have to check in with that 78 sma on the daily at some point, and when we do equities should rally.

Peace. Om.

ReplyDeleteIF this is P3 or something like that

I think everyone here knows where I stand on that.

The GDOW looks like a 3 down has started. I'm going with it's 3 of Minor 1 of Intermediate 3 of P3 down. If it's 3 of Intermediate 3 already... well, I doubt it is, but if it is, look out below.

Roger. Wasn't saying it was or wasn't.

ReplyDeleteIz cool.

ReplyDeleteHere's a GDOW chart.

http://i.imgur.com/bCelD.jpg

Love your GDOW chart!

ReplyDeleteI raise you my updated yearly NYSE chart

:-)

ReplyDeletefrom Jesse's Cafe Americain Wait until their commodity derivatives book blows up. When Blythe Masters famously said that 'the rest of the market is scared shitless of us' perhaps it was true, but not for the reasons that she had imagined.

ReplyDeleteI posted on my blog a few days ago a downgrade to sell on JPM by CLSA analyst and attracted much opprobrium from our favorite troll ...."No one cares about CLSA" etc etc LMAO !

http://www.moneyweek.com/investments/property/us/pick-up-prime-us-real-estate-property-58324?utm_source=newsletter&utm_medium=email&utm_campaign=Money%2BMorning

ReplyDeleteThanks Pebble! Ironically, I went into schwab and pulled paperwork to open an account and while talking with the dapper young man who was helping me and telling him of my concerns about brokerage houses and banks he told me he had as much faith in the integrity of schwab as JPMorgan, another one of the best.

ReplyDeleteIm seriously wondering if being in this market is a good idea. We talk about this house of cards, and when the day comes that panic ensues, these outfits will simply have a tech glitch and we won't be able to transfer fro our money market to bank accounts until it's too late and the damage is done. Like MF Global, they will use our money to cover their losses.

On the other hand, pretend and extend is about done. People are waking up. I bet Europeans have a much better grasp on world finance than most Americans. But then, I think they always have.

Thanks again for your input. Will probably have to subscribe to a TA service. May even look into other brokerages...

He was smiling... That's right. You know, that, that Luke smile of his.

ReplyDeleteHe had it on his face right to the very end. Hell, if they didn't know

it 'fore, they could tell right then that they weren't a-gonna beat him.

That old Luke smile. Oh, Luke. He was some boy. Cool Hand Luke. Hell,

he's a natural-born world-shaker.

The markets have been messing with investors' heads since Monday so I doubt it's going to finish today with any great moves one way or the other. It'll probably finish today just as it does every other Friday... with ?????? everywhere. It's a pure gamble to be long OR short going into the weekend... just the way the banksters like it.

ReplyDeleteOh, I get it now. The AUD/JPY is like a Magic 8 Ball of short-term indicators, and right now it's saying "Answer unclear. Ask again later."

ReplyDeleteYup! Not even the currency traders know what the hell is going on.

ReplyDelete30 minute OR break was dead on again today, fwiw.

ReplyDeleteYou said it last night bro.. bear flag. Has a slight upside to it so guess it quailfies. looks corrective too, choppy overlaps.. setting up for a pivot low 14 or 15 May...best guess.

ReplyDeleteTracking with the 14-15

ReplyDeleteHad a serious sense of deja vu with the Jamie Dimon admission and the predictable PPT response... enjoy!

ReplyDeletehttps://pebblewriter.com/there-is-nothing-wrong/

I actually had this picture in mind when I posted that comment about the bearish pennant. It was the Russell (IWM) and not the S&P. But it also didn't pan out exactly as I was fearing it would. So I dunno man... it's just too dangerous playing on this freeway right now.

ReplyDeletehttp://stockcharts.com/h-sc/ui?s=IWM&p=15&b=3&g=0&id=p29221835690&a=261233800&r=1336711481551&cmd=print

This is one of those days when the best bet is the sidelines

ReplyDeleteOr a trade with an expected life of 30 minutes

Yeah this is excruciating. Nobody should be in this market today. So I just went short RUT for the hell of it, lol. That H&S potential is just too good to pass up. I've probably just donated another chunk of cash to JPM but we'll see. The market internals are just shyte so I don't see how there can be any upside unless the vast majority of stocks on the NYSE suddenly turn higher next week for some unknown reason.

ReplyDeleteThe markets are at a severe moving average compression on the smaller time scales. So whichever way the market breaks is going to swing "all of them" in that direction. The move is going to be relatively hefty either way.

ReplyDeletePebble I assume you wrote that? If so, get it published man... that's another gem. You still got JL's email address?

ReplyDeleteThanks. Guilty as charged. Just got an email from JL. Apparently they're publishing it later today.

ReplyDeleteBest,

PW

I think the move is up.

ReplyDeleteHere's the weekly chart of our friend USDJPY:

ReplyDeleteLet me know if you all have a similar count ... finishing up wave 4.

Wave 4 has just the slightest overlap with wave 1 ... I think that's allowable in markets other than cash markets (these currency mkts are highly leveraged).

A doji there this week.

And it hit the parallel line to 1 & 3, so it would be a nice tidy 2 & 4 line.

Not a real tidy fib retrace, but between 50% and 61.8%.

And the 13 week cycle (that it's been mindful of) finished today.

And during the low volume week Japan was on vacation, they dropped it inspite of news of printing 1 trillion of em.

It broke out of a 10 day down track.

Perhaps it's now time for the real move.

I'm starting a long position. Nibbling.

What was the 2B loss at JPM? They mentioned credit default swaps, but were very vague. Must still have to unwind them.

ReplyDeletetook a small long position in ES.

ReplyDelete- i have seen the phrase 'sell in may and go away' far too much in the mainstream

- bearishness everywhere on the blogosphere

- totally clueless mainstream people i know are bearish and are telling me how worried they are

- we're in a c of 4 with either the bottom in place or a bottom to come at 1322, 1300, or 1297

- 5th wave up will be followed by a grinding LD down into the disgusting US death ritual called an election

i think the 2012 meme is as powerful if not more powerful than the y2k meme. following that analogy, the mainstream will awake to a world pretty much unchanged on jan 1, 2013. shortly thereafter, the shit hits the fan.

They won't let it breathe....dunno...clazy market

ReplyDeletehttp://i835.photobucket.com/albums/zz279/SoulJester/Insanity.png

anybody got a 1370 print at 3:25 pm???? Freestockcharts showing it...

ReplyDeleteExcellent, thanks. JPM has 78 trillion in derivatives! As you say they are losing control of their derivatives trading.

ReplyDeleteAnd he admits "volatility in earnings will increase."

And people think things are "fixed" from 2008. When investment banks were leveraged 30:1 or 40:1.

What a joke. JPM is leveraged 78:1?

Excellent post friend!!

ReplyDeleteYes, I could swear I saw it on an $SPX chart but it's not there now. But it's still on the SPX charts.

ReplyDeleteAbout two months ago I had read that JPM's derivatives exposure was 90 tril. How insane is that? Here's a graphic that is just a mind blower.

ReplyDeleteAbout two months ago I had read that JPM's derivatives exposure was 90 tril. How insane is that? Here's a graphic that is just a mind blower.

ReplyDeleteExcellent work my brother. You've got very nice talents.

ReplyDeleteThanks, Greg. It's a great business model: keep swinging for the fences, cause the Fed will allow you to stay at the plate as long as you like. Heads they win, tails we lose!

ReplyDeleteFinancials continued to get slaughtered today:

ReplyDeleteBAC -1.95%

Goldman -3.94%

MS -4.17%

Citi -4.24%

JPM -9.28%

Here's the numbers and the article to go with the graphic. Insane is the perfect word.

ReplyDeletehttps://pebblewriter.com/city-of-dreams/

Thanks, I saw that graphic a week ago but now I saved it so I can pass it along to my family.

ReplyDeleteYes, the average price for an average home in Vancouver is $840,000. That would get you the typical 1100 sq. ft. 3-bedroom bungalow.

ReplyDeleteThe exposure those pigs have to derivatives is something like 10 times the entire GDP of the whole USA. Something like that.

ReplyDeletejust keyin off the weekly European index charts at the moment...ignore the noise,stay short jmo

ReplyDelete'ghosts..inthe machine'. ;)

ReplyDelete--

Interesting, since we closed rather low today, maybe the late monday/tue morning peak will instead be a mere 1370 for this C wave?

Something I'll keep in mind.

I like your reasoning, but I raise you my monthly SP' chart.

ReplyDelete--

Hi AR

ReplyDeleteIts midnight...just a few late night thoughts/comments from the bear bunker...

Talked with a fair few traders today, some are bullish into next week, some confused..some..just waiting for much lower levels. I guess that sums up the 'normal'. Maybe I've read too much today, but I'm not mixed as to where the hell we go for the rest of this month.

I suppose at least I am being careful right now, I had a reasonable week.

I see a real threat though. The MACD cycle on the daily chart is already low, and this is a real problem to the bears next week. I'm really concerned that new highs are still possible if the hysteria returns - we have the FB ipo still due soon.

Past 'doom cycles' would suggest we have 1-3 days more up..to 1370/80..and then rollover..but what if we just keep on going up again? I am increasingly hearing more chatter about a mid-june high of 1460? Sounds crazy, but its not just one lunatic, i am seeing it in different areas from people of different perspectives.

I'm at least not in any positions this weekend, I guess I'll at least be able to start next week afresh.

Its probably a truly twisted thing for a permabear to say, but I quite hope futures on sunday are sp+15....urghh.

Have a good weekend

yours

watching cars go round in circles on a road in Spain

Agree on all points but the 2012 thing. No one of sound or serious mind believes this. If anything it is probably the opposite - most cling to the notion progress and promise of an unlimited future will always deliver us from any nearer term problems.

ReplyDeleteThanks man. I like to use it with a combination of EMAs of the StochRSI (something AR clued me in on via Scottick and something which I'm still grateful for). I'm grappling with the math but there's plenty of time for that. More importantly is whether it gives good signals which I think most of the time it does. Some fakeouts but I use it in conjunction with bollinger bands and of course wave counts so most of the time so far they all are seeming to gel.

ReplyDeleteI think you are right when you use it to time a 5th wave it is golden

Back atcha, bro.

ReplyDeleteI struggle with a couple things. Indicators say bounce. Sentiment, anecdotal and otherwise says bounce. But, if those that have been so wrong for so long are finally right that might not matter. Hard time here in ole market.

ReplyDeleteI was thinking they were holding it down all afternoon and one slipped through for a second.

ReplyDelete"I see a real threat though. The MACD cycle on the daily chart is already low, and this is a real problem to the bears next week."

ReplyDeletePD, in the event a new bear cycle has already begun, then that MACD is going to get into oversold and stay there for months on end, eventually producing one positive divergence after another as the market just keeps on falling. Just exactly the same way it got into overbought and stayed there for months on end during the bullish cycle, producing many negative divergences along the way... all the while the market just churning higher and higher and higher. On the other hand, IF we are still in the bull cycle (and nobody knows), then yes, the MACD may be flashing a buy signal soon. That's what is referred to as "bull rules" and "bear rules"... which one is in effect right now? Judging by the stochastics on the daily chart I'm not seeing any danger yet for the bears. True, it is getting down into oversold territory but could conceivably have days and days (weeks even) before it's ready to pop up. So the bottom line is that as of this weekend I'm not concerned from the bear's point of view about the MACD, RSI, stochastics or any of the momentum indicators.

"I am increasingly hearing more chatter about a mid-june high of 1460?

Sounds crazy, but its not just one lunatic, i am seeing it in different

areas from people of different perspectives."

Don't get me wrong here PD, but in all due respect to those people I can't allow myself to care what they think. I say that very respectfully, but if I listened to any of them, or 'all of them'... I still wouldn't be as much as 1% the wiser because they don't know which way the market is headed either. They think they know but they don't. Neither do I. All those opinions... and I respect them all and respect the vendors of said opinions... they don't mean a pile of coon poop to me because those people don't know where the market is headed.

Who in their right mind could allow themselves to be influenced by the opinions of others? I could care less about what other people are thinking unless they are astute technicians such as Pretzel, Danno, Pebblewriter, etc. Are all these voices we are hearing that are barking out their projections somehow "more in the know" than you or I are? More "in the know" than Pebblewriter is? More "in the know" that Daneric is? More "in the know" than Pretzel is? Nope! Not one of them.

I say all that with the utmost respect to all of those people. Some of them have their methods. Some use analogs which I personally don't buy into. Some of them use statistics, which is commendable but not important to me. Some of them show charts with 'evidence', evidence that is complete misread in some cases. Some will show a chart that makes a gread deal of sense to me and then draw the complete opposite conclusion that I would have drawn. They 'might' be right. But 'I might' be right instead.

Again... I say all this with respect and love for those people (I'm a bit easy on the 'love' theme though, lol) but I just cannot allow myself to be disuaded from following my own course with my own work and my own conclusion because of the noise is coming from hundreds of our dear friends. You and me... we need to keep our sanity man, lol. Listening to the throng is not a good step in that direction :-)

How do we trade that analysis?

ReplyDeleteWhich ones and why? This is important.

ReplyDeleteSomebody tell me if odds favor a massive wave down, and why, puhlease.

ReplyDeleteA new article from Tom McClellan: Is JPM the Burning LOH?"<.B> (light observation helicopter)

ReplyDeleteInteresting. So he sees corrections ending on bad news?

ReplyDeleteI'm not a subscriber so I don't get to read his newsletter. But I gather that he sees a big bottom forming in June (in equities). At least that's what he said on Feb. 3 in this article.

ReplyDeleteJudging by the JPM article though it seems that he's envisioning a drop in the bond market. Does that 'necessarily' mean equities have to rise just because bonds start dropping. I don't think so, not this time. Who knows when the bond market is going to start heading lower though anyway? If inflation starts to get out of hand then the normal way the FED battles inflation is to hike rates. There's not a hope in hell Bernanke will ever hike rates but then it's not Bernanke who controls the bond markets, it's the bond market itself. At least it 'used to be'. He's really messed up that market too ever since the FED became the 'only' buy of US bonds left in the world. To be honest, I'm a bit confused about what his call really is, lol.

I see you asking that question over at Danno's too SJ. I don't think anybody out there has the answer. If they did, we'd all be rich.

ReplyDeleteBut all I can say is that a major deflationary event is unfolding before our very eyes in Europe. Greece has defaulted. Spain is going to default. These are deflationary events. I just don't see how the future can hold anything 'other than' a massive wave down. But I've been wrong for two fucking years now so what do I know?

All anybody in the world has witnessed is gravity being defied by massive injections of money from the FED and the ECB. Those cash injections have been able to defy the deflationary theory... so far. When Bernanke says he sees "little inflation on the horizon" I don't think he's lying. He's not talking about prices of gasoline at the pump or the price of a jug of milk... he's talking about monetary inflation. He sees little because there is none... there is massive "deflation" going on right before our eyes (the disappearance of money out of the system) and he's doing everything in his power to counteract that by providing liquidity. He's in full blown panic.

So where is the stock market crash that should be coming as a result of deflation? Deferred until the FED runs out of bullets. Yes, the odds favor a massive wave down. But Ben the Benevolent has deferred that event and will keep deferring it until his balls fall off. So who knows "when" the wheels fall off the market? I've been expecting it for a long time and for all I know the rally that started on May 9th, 2009 will continue for 6 more years. I don't freaking know... but I know the "odds" favor a massive crash.

We don't know yet whether or not we have actually entered a bear cycle in which case "bear rules" apply. Maybe there's one more gigantic leg up remaining, and if that's the case then the bull rules are still in effect. I dunno which it is yet. Nobody does. But if we're still in a bull market, then the MACD signals that PD is referring to should be acted upon and an investor should go long once they issue the 'buy' signal. I'm not convinced either way yet. If the neckline on the Russell gets broken next week, we might find out in a hurry which it's going to be. If it holds and the markets start to scoot off higher, then I guess we're off to new highs.

ReplyDeleteAs of this afternoon I'm short. On Monday I might wish I wasn't short but I'm just going with the fact that the market internals are just totally smashed and dropping. The financials are just getting ripped apart, etc. I don't think I can go long when the market internals are getting crushed like this. But some people will go long and I wish them the best.

I focus on Ftse and Dax as they are stronger ..the weaker ones are dangerous because they are so oversold .

ReplyDeletehttp://1.bp.blogspot.com/-u2AUYz3ZyN0/T65a17q1OCI/AAAAAAAAKwo/NOQ50gJJ6TA/s1600/dax.jpg

Check out San's Ichimoku sell signal on the S&P http://niftychartsandpatterns.blogspot.co.uk/2012/05/s-500-analysis-after-closing-bell_12.html

SPY gap at 132.68 (SP500 1325.54) market may target to fill next week. T Caldaro has support down at the 1313 and 1303 pivots. I now think 14-15 is to early for a low.. out to 18 or 21-22 is more likely. All depends on what happens early in the week!

ReplyDeleteanother Dax chart http://2.bp.blogspot.com/-XE5d9qhYgag/T65-z0sZdYI/AAAAAAAAKxE/5efmuWGukdQ/s1600/dax.jpg

ReplyDeleteHave been a subscriber for a few years now... McClellan has some really great stuff and overall he can be very cynical which usually makes for a great investor in my opinion...Right now he is driven by two things he sees---his Democratic Presidential Cycle Pattern which does show a different texture than typical seasonality and says your bottom comes earlier than normal (before september)---he currently thinks the price low is on Monday...this mathces some of the things I think SJ has had recently on timing--- his dates are May 14th and May 30th... the other item he is using to confirm this is his Eurodollar COT shart which is really compelling the way it works, but it also is showing a bottom more early-mid summer..personally I hvae seen McClellan be really right and also really wrong...looking at all the charts in the intermediate term I simply do not think we are only going to have a about a 6% correction given the charts are rolling over on a more intermediate term basis...

ReplyDeleteNot a tru waver by any means...but looking at the longer term charts and technicals on the weekly's and monthly's we are at corrective period.. just look at Stochastics and MACD and they are most telling...each of our major corrections have been significant and swift so I would say yes we should at least get a 15-20% correction sooner rather than later...is it P3, I have no clue but all the ingredients as I see them are there for it...

ReplyDeletecould be an island reversal shaping up on JPM--have to see if can open above that 38 level next few days... or could be what it looks like...death... I will go with the latter...

ReplyDeleteSo, we have essentially 3 scenarios.

ReplyDelete(1) The we going to a higher high scenario (1427-1511). That most likely requires that we bottom in this arear, similar to mid-March 2011. However, if we don't hit the 38.2 arear at 1320ish then it violates a GUIDELINE of elliott wave that if you get a deep 61.8 retrace for a wave 2 then your wave 4 should be deeper (38.2-50) and not the shallow 23.6.

(2) The we are going to bounce and then go down scenario. This would be similar to June 2011. This is the one I have been trading (June Swoon and then up). That scenario pretty much requires we hit the 1320-24 arear (I have it at 1313ish) and then bounce hard. Cycle wise this could play out with a low this week, a high around May 22, a low around May 30, and a high around June 12. Last times 3 times we did something like this it was 100 SPX points or more.

(3) The we going straight down loike it is July-August 2011. That would make the past 3 days complete bullshit in the market, which it generally looked like. We would be at 1190-1200 pretty quickly under this scenario. Instead of mocking this scenario, I would really prefer somebody negate it for me cause so far I have not been able to.

Anywayzz...so nows how do we trade that. I gotz some idears but working on it. Big thing that bothers me here about scenario 1 and 2 is that trend is down and pretty bearish looking. Big thing that bothers me about scenario 3 is it seems pretty out there.

Is his eurodollar COT bottom in June or later???

ReplyDeleteAs for scenario 3, there are some things that just generally concern me about the fact that I cannot negate it on smaller charts.

ReplyDeleteFirst, in the NYSE, the yearly upper channel held as resistance

Second, if that was only 3 waves up off the October low, which the bull case assumes, then if the bull case is wrong, we are in a 3rd wave down at this degree, and at lesser degree.

If October to April 2011 was a 3 waver, and if it was preceded by a 3 waver, then absent a triangle this is in play

That is concerning because that would put the 161.8 extension in play at SPX 900ish, which fills a gap down there and is also, if anybuddly was around when it happened, the exact place this bull wave took off and trapped all the bears looking for 450.

Anyway, not trying to be a gloomer or a doomer, but it would be noice if we could negate the big puke here as it would potentially be a stronger puke than the 2011 puker.

will try to post it...June 4th is the bottom of that chart... most interesting is that this chart shows really big drop in December which to me would then be wave 3 and make the entire rally look like giant megaphone pattern from march 09 bottom....check out Permabeardoomster scenario B on spx and this is what the Euro dollar COT chart looks like... the idea being that Eurodollars trading shows stress on the system and does not show up until a year later in the stock market....so basically big drop then QE3 and Rally lasting about 5 months and then it's over and then it's over and head for the bomb shelter....

ReplyDeletejust looking at past and thinking fed is in a bind here... my thought is we have to have a sell off before they can QE3 the bitch... so we get what you are saying and it is a fiver and then they pump her up again and the rally is strong but only lasts about 5 months before everything really falls to shit...but hey maybe just thinking it through too much and siumply going to play the charts here...I will give it a week if they don't break 1390 then will stay short... which is what I think right now.. there are just too many charts that look like crap on a longer term basis to think that they just stop and turn around here.. just don't think we have bottomed yet...

ReplyDeleteThank you!

ReplyDeleteChairman, I don't know what happened but I found your comment in a bin where it was awaiting "approval". I don't have any of those settings turned on so your comment should have been published immediately. My apologies but that was a 'first'. I've given you "whitelist" clearance as well so you shouldn't have any problems posting here 'ever'. All your comments should bypass the spam filters too. That's how Disqus is 'supposed' to treat people who have whitelist clearance but Disqus messes up so often that I wouldn't trust it as far as I could throw it. My apologies but it wasn't something that I caused to happen. Hang in there.

ReplyDeleteHey AR, no worries mate, cheers for fixing this problem. When I posted my comment I got a message it was subject to moderation before it disappeared.

ReplyDeleteSome more SPX talk, it wasn't 'till I looked at an intra-day chart I spotted another gap in the SPY lower down at 131.32 (SPX 1312.41), which the bears may also target to fill. So, two open gaps at SPX 1325.54 & 1312.41 and based on his OEW count, Tony Caldaro has Fib relationships giving targets in the range of SPX 1313 & 1327.

I am not expecting a market crash or waterfall decline at this juncture, but I am looking for a big rally out of the pivot low that could take SPX up a few hundred points. I'm planning to open long positions at or as near the pivot... Currently I'm still holding TZA for a lower low in the Rut this week. Need to see how things develop on Monday and Tuesday. Later Bro.

I have the same two levels fwiw. 1313ish and 1324ish.

ReplyDeleteI'd favor scenario 2. Mainly because P3 is a huge wave and it won't be a straight line down.

ReplyDeleteIf the GDOW is reliable as a social mood indicator, and the larger degree count is correct, and we're currently in 3 down of Minor 1 of Intermediate 3 of P3 down, then we're looking at a Minor 2 bounce at some point. As bear market wave 2's act like bull market waves, it should be a vigorous retrace.This is where it could get really interesting. Let's say the bottom of the GDOW's Minor 1 down is where more QE is announced. Then it could be a really big bounce on the US tickers, maybe to new highs, once again busting big-picture counts for EW theoreticians still relying on US tickers as a social mood road map. The GDOW won't react as strongly since it isn't as easily influenced, so I'm guessing its bounce would likely stay within the bounds of a Minor 2.This all sets up the point where social mood is such that exuberant confidence in QE finally plays out. The "point of recognition" people say is coming. When that GDOW Minor 2 peak tops and QE confidence comes to an end, there's nothing left. That sets up the Minor 3 of Intermediate 3 of P3 plummet down.

Just speculating a bit here, but as I said, it could get very interesting.

http://i.imgur.com/bCelD.jpg

AR,

ReplyDeleteAdd the FAGIX:VUSTX ratio to your list of reasons "Why to be NOT bullish". This week it dropped below its 89EMA, even with a small backtest already.

Moreover my brand new PPO ROC'n roll indicator is deep red and dropping without signs of divergence (yet?).

TX

Thanks for all the help and posts and charts!! After much perusal and pondering,

ReplyDeletewe might not be quite at the bottom yet time wise or we moight be. Close or this is armageddon. New moon a coming. People feel risky when there is less lunar light. I am staying with the June Swoon scenario that has tracked so far so well for me and the May 14/15 bounce arear in that scenario.

Daily charts are a big bounce arear across the board (currency, commodity,and equity) or nearly so with the lesser chance that a big pin job is put on 20 indexes at the same time. But, weekly charts are in more bearish territory, but not the pinned bearish territory where we absolutely must go down right now, but bearish nonetheless. So should be an interesting June.

Imma gonna look for a May 14/15-June 21/22 long trade this week. What I planned to do anyway. Should have just saved the time and not bothered looking at charts lol. Haven't planned the trade part. If I am wrong, I am Bodhi and this is the 50 year storm and I guess that makes the market Johnny Utah.

If anybody has a compelling we ain't gonna bounce chart, would love it! Merci and hope you are all enjoying your wochende.

ReplyDeleteFor what it's worth, I'm a huge fan of that theory. I hadn't spotted the gap you'd mentioned in your first comment so when I pulled up a chart to look at it... I thought "BINGO!" That makes a ton of sense IMO. There is another thing that's happening for the first time in months... all the momentum indicators are putting in a lower high. That's not unusual of course, but what is different this time is that for the for the first time in months, those new "lower highs" in the indicators are being supported by new "lower highs" in equities as well. They're in sync and they're heading lower. SPY 60 min.

ReplyDeleteA new post is up. This one has gone dead as a doornail and that's usually a good sign to freshen things up. And Chairman has provided the perfect excuse. We might as well move the conversation over to SPY 133 - The Gap Beckons.

ReplyDeleteThanks TX... I had put that one so far on the back burner that I'd forgotten about it. I won't have any time off now until Tuesday so that would be the first chance I'll even get to take a serious look at what other signals might lie hidden in that gem.

ReplyDeleteNice to see you back. We hadn't seen a post on your site for nearly 3 months so I thought you'd shut 'er down.

Please don't feel obliged AR, because to me you're not.

ReplyDeleteDue to rather time and energy consuming personal matters (still a work in progress) I didn't find time to post, but I kept visiting your blog on a frequent basis, just as I do with Pretzels and Binve's. I hope to get posting more often again. Today's post (and the coding that went along with it) really was fun to do. So no, she isn't dead and I'm still fighting for her live. She is such a pretty baby, isn't she :) ?

Anyway, thanks for adding me to your bloglist again!

TX

Hey, AR, did a post just get vapourised by you?

ReplyDelete---

hope you are okay...

I think its time the community turned on those who have taken their sites private, and yet keep throwing their little teasers out there. Its nothing less than spam. You need to do it too, we know who they are.

Cleanse the bookmarks, get rid of the filth.

Gold

ReplyDeleteThis is hard to believe.

Clearly JPM is dumping their shorts.

http://britefire.wordpress.com/2012/05/23/266/aucot/

But despite two hi vol drives down:

7,500 contracts on Monday, Apr 30th.

14,000 lots May 8th

the continued attempt has been unsuccessful

in breaking the Dec Lo,

and buying all the stops below it,

on the May 15 down move or today.

And today after approaching it

a long tailed hammer reversal.

http://britefire.wordpress.com/2012/05/23/266/triplbotkya/

Either they are luring in more longs

to build up the stops

or there is veeery strong buying

at this level.

Yeah, I closed that one down. Just getting infuriated at some of the comments, nothing to worry about. I guess you might not have noticed but I had already told the readers that I was on the verge of shutting the whole site down June 1, and why. I'm even more convinced today that it's right thing to do.

ReplyDelete"I think its time the community turned on those who have taken their

sites private, and yet keep throwing their little teasers out there. Its

nothing less than spam. You need to do it too, we know who they are."

I have to admit though PD that I don't quite know what you meant that that one. I never suspected that any of our troubles were caused by other bloggers.

Ohh, no , I just have a real thing about those who take their sites private. It pisses me off, even more than the Bernanke annoys me. Sure, its their right to do..and I actually congratulate those that can do it, but considering the times we are in, whenever i see some site disappear its just...god damn annoying.

ReplyDeleteWhat about if ZH decided to go private? Thats one of the greatest websites EVER. The ZH leader..Tyler, he is on a mission of mercy to inform the globe about the crazy times we are in.

--

Over the last 3 years I've seen so many god damn many of them 'go dark'. hell, even chart pattern trader (Ron Walker) went offline a few months ago. He was one of the best youtube posters out there, and I always supported him.

Now, Pebble has gone...Pretzel is doing the exact same thing.

--

Hell, its a wonder chartrambler is still around!

Don't you go AR ! You're the only 'personable' site I know of thats left. Daneric is around of course, but his site is still largely filled with lunatics, and besides, Daneric (whomever that 'thing' actually is), is really not a participant on that site anyway. The irony of it !

-

I see what you're getting at. Yeah once I get used to a site that I like and then it goes dark, it bothers me too. But I don't blame them if they think they can generate a decent income from it. But it's a very balsy move and I don't think many find it worth while. That's certainly not what I have in mind.

ReplyDeleteI really do appreciate your generous words PD, but even though I insist on offering a 'personable' site, the vast majority of readers prefer the excitement and the mayhem over there. It reminds me of one gigantic low quality neighborhood bar where all the locals hang out every night, with loud raucous music, fights in every corner, lots of laughter, lots of pseudo-comradery and a few good souls who just can't stand taking the chance that they might miss out on something by not being there. It's a world I don't mind as long as the thugs aren't allowed to rule the place. But they are.

Pebble? I love the guy and wish him the very, very best! Pretzel, same with him. Both are top notch operators and I like both of them a great deal. But I assure you PD, I have no intentions of going 'subscription' or 'dark', if 'dark' means 'paid'. LOL... in order to go subscription a guy has to have something worth offering and on a daily basis. I don't.

Very interesting Britefire but I have to admit I'm a bit confused here. Are you saying that JPM was driving down the gold market but has capitulated on that idea? Or is it a case where they're just in so much god damned trouble that they're raising very badly needed cash from any and every source possible? I'd think it's the latter because I don't think there's any chance JPM is prepared to see gold take off upward. For one thing, if it did there goes the last chance for any more QE. With gold confirming that inflation is very real and starting to soar, there would be absolutely no way the Bernank could fire off another round. What do you think?

ReplyDelete.. never a fan of bars.

ReplyDelete--

I was just staring at the 2008 wave. The first main wave took 8 weeks, no panic, ..no big drops..just relentless crawl lower over 8 weeks. The bounce was 100pts...before the real action began.

Every cycle is unique...its just something I am wondering about.

--

Good wishes.

See that final wave 5 of 5 over on the right hand side of your chart? Nobody ever could explain to me how that is a fiver. In fact, back then one EW technician who I really respected was so incredibly adamant that a 5th wave absolutely can not end in a 3-wave sequence that it just killed me for months and months and months... waiting for that final 5th leg lower. I'm still waiting for it, lol.

ReplyDeleteI'm guessing JPM is in serious trouble trying to unwind whatever their trade was so big it cornered the market, and now others are taking the opposite side. Derivatives probably, just not sure which ones? Corporate debt? But it would make sense they would sell anything they can.

ReplyDeleteWell, I never get too adament about the numbers.

ReplyDeleteLike yesterday...which was a perfect example.

Dow breaks upper channel..we are holding fine until 3pm...The 60min chart on the indexes are clear baby bull flags...- as i posted at the time.

ohh, but then the greek ex-leader comments..and it all collapses in mere minutes!

Yet, the Elliot maniacs - and they ARE maniacs, will not want to hear, never mind discuss such an issue.

This market..the twisted sick thing that it is..does have cycles, but they are so immensely messed up, it makes definitive counts/waves arguably pointless to try.

-

We have a nice down channel on the hourly, and daily still.... but hey...all it will take is one sentence from someone, and it'll be break up and out..or we collapse back down to a new low of sp'1280.

The ellioticians don't like that kind of comment, and they can't ever admit that in this unstable news/hysteria driven market...its mostly too noisy to make reliable counts.

I will keep using the terms at times, but I do hope I get the point across to my readers that I look at this wave-counting 'rule-set' as mostly nonsense.

*futures, dow-34.

Ohh, thats another thing. I can't take futures seriously either way, unless i see +/- 175. Anything less, and its within the realm of 'noise'.

-

yours..

tired.

The Feds long term policy

ReplyDeleteis to debase the dollar

A rising dollar, as it is now,

is against the interests of TPTB,

who control the govt thru lobbyists.

I do not think Bernank's policy

is in conflict with theirs.

The commercials are now *heavily* long Euros.

http://britefire.wordpress.com/2012/05/23/275/eurocot/

So, it may be in the cards

for the dollar to drop.

So, gold may be rising in terms of dollars.

So, at the moment

the interests of the other PTB

may conflict with the interests of JPM

and it's time for JPM to realaign

by eliminating their shorts.

According to my reading

fiat is increasing at 7% per yr

gold supplies at 1% per yr.

My guess is that gold at 1900

was a wake up call to JPM.

They are humongusly short

compared to what they could be called on to deliver.

They see the handwriting on the wall.

And for them, its now or never.

Speculation is, they certainly need the cash.

Tho, I don't think they capitulated eaisily.

I'm guessing that for the moment

they ran into someone as big as them

and they couldn't drive lower.

I totally agree

there is no chance JPM is prepared to see gold take off upward

till after they can dump their shorts on the institutions,

[if they have a choice].

Thats why not breaking below the Dec low

and covering their shorts with the long contracts for sale there

is so strange.

What ever they say at the FOMC,

in order to cause the dollar drop,

I believe they will continue suruptitous QEs

like Operation Twist.

And, that will support golds rise.

Tho, TPTB will always sacrifice the people's interests to theirs,

Bernank's problem is

an election is coming

and Obama wants the market up.

QE3 will do it, but be unpopular.

Rising food, gas, dentist, auto mechanic, and education bills

will ruin him.

He will have to find a way to blame oligarchs, like Romney.

Very interesting thoughts Brightfire. Thanks for the input.

ReplyDeleteApologies if I offended anybody here. I will move on.

ReplyDelete"To forgive is to set a prisoner free and discover the prisoner was you."

I must have missed it. What you said, and what comments AR was irritated at, and who said them for that matter. I'm sorry to hear you're moving on, I always appreciated your wealth of currency/market experience and willingness to share. Peace. Ommmm.

ReplyDeleteHere is the USDJPY daily chart. It's time for a move soon. Up.

ReplyDeleteDaily MACD is about to do a bullish cross for the 2nd time. They've converged.

We're at the monthly bollinger band at support 79.409.

We've pierced the daily resistance line twice, and about a third time.

This wave 2 got to about 61.8% retrace at 79ish.

We're at a tip in the triangle off the bottom move.

M3 Financial analysis over on the links on the right here makes a very good point ...

ReplyDeleteJPM and the rest of the idiotic banks and their hundreds of trillions of derivatives are all short the dollar.

Ooops ...

So the dollar spiking above 81 yesterday is not a coincidence that it came a week or so after JPM's blowup loss.

You haven't offended me SJ. I LIKE you!

ReplyDeleteDon't move too far away, now... Yehear?

AR,dear... Why are you so concerned about Daneric's site and what is happening over there? Really, does it have to have any bearing on your site?

ReplyDeleteWho cares if some of those posters come over to your site or not?

The web is full of participants and you can attract from many areas, not jus Daneric's. The people you want to attract will participate because of the nature of your site, period. I thought the nature of your site was to enjoy each other in a cordial manner and share market insights. Period. If the nature and objective of your site is to draw from Daneric's site, well, then yes, it won't go far.

If your site was simply established to draw people from Daneric's site and you feel your site has failed, Id like to suggest that you consider altering how you look at your site and the reasons for establishing it in the first place.

AR you out there? I've been busy all week, haven't had a chance to check in since Monday, looks like your most recent post evaporated? Anyway, ES not a crystal clear picture very short term although I am long, but that could change by the end of day.

ReplyDeleteWait. What? Nooooooo!

ReplyDeleteI have no idea what this is about but somebody's gonna get a talkin' to if this shit ain't worked out right now. And I was planning to stop in Lake City and take you all to Dog'n'Suds but that's off if you don't all shake hands and treat each other right.

Nice call buddy!

ReplyDeleteAnd with this 1:30 spike, it's making a 3rd attempt to break free from that downward daily resistance line.

As SJ would say if he were still here ... you can dooooiiiiitttt yen!

AUDUSD hasn't looked this terrible on the monthly chart since 2008! As far as technical damage.

ReplyDeleteThink those big banks are probably really losing big money on unwinding carry trades.

Made it thru all those moving avg lines which is unusual.

AUD is certainly a train wreck, so is the EUR. Wish I was in those markets, used to trade them but didn't have the time.

ReplyDeleteAnd the indexes could be coiling up for a big 5th down. One of those extended dealies, surprise to the down side. And watch the VIX. A spike to the 38.2 Fib off the Sept 2011 highs could ruffle quite a few currently sleepy feathers.

ReplyDeleteBear flags on all the daily cycles. Or just look at many of the individual company charts, they are all bearish..and hovering just around the important 10MA.

ReplyDeleteYet, Friday will probably be quiet, with the 3 day holiday.

USDJPY- If we can clear the magic 80.14, we could be in business Greggo.

ReplyDeleteMucho tech probs this week, so no charts etc yet...

Always glad to hear you are thinking something similar. I'll watch for that 80.14 proof.

ReplyDeleteGood luck with those tech gremlins.

Also glad you are still around and haven't left like some others.

ReplyDeletelikewise amigo. I see AR is getting rather jaded & many people getting 'blog fatigue'. SJ seems to be still going strong and still hasn't slept since last Christmas.

ReplyDeleteUSDJPY approaching the golden trendline soon near 79.85...oooh aaah.

should have some charts up later, but so far that potential low for BIG(2) at 78.99 is still in play

crickets.

ReplyDelete..but.. it's right at 61% retrace on 60min chart now...so....careful here

ReplyDeleteUSDJPY 15min

ReplyDeletehttp://screencast.com/t/lvAtakOgN

Hello Albertarocks and all dismayed followers.

ReplyDeleteIf I may be so bold as to say, with the greatest possible respect of course, your post above "We might as well move the conversation over to" is what it's all about. Daneric posts what he wants when he wants and the rest of the time he just thows a new chart up twice a day and lets everyone else do the rest. I respect all of your criticisms of Daneric but his site remains vibrant because it isn't all about him; it's about providing a platform on which others contribute. People come and go all the time and can be the life and soul one day and gone the next. You are probably well aware that you are still the most active member on his site and have received the most likes of anyone there. I don't know whether you wanted this to be direct competition or friendlier but better policed or even just a soapbox from which to deliver your wonderful charts and analysis. I'm sorry I failed to mingle at the party while it lasted but would urge you to either reconsider your decision to close, or reformat how it works, or install yourself as the life and soul on someone else's site. People do and will miss you..... but they'll get over it.

The Indispensable Man

(by Saxon White Kessinger)

Sometime when you're feeling important;

Sometime when your ego 's in bloom;

Sometime when you take it for granted,

You're the best qualified in the room:

Sometime when you feel that your going,

Would leave an unfillable hole,

Just follow these simple instructions,

And see how they humble your soul.

Take a bucket and fill it with water,

Put your hand in it up to the wrist,

Pull it out and the hole that's remaining,

Is a measure of how much you'll be missed.

You can splash all you wish when you enter,

You may stir up the water galore,

But stop, and you'll find that in no time,

It looks quite the same as before.

The moral of this quaint example,

Is to do just the best that you can,

Be proud of yourself but remember,

There's no indispensable man.

Phil, I'm so sorry you, Divine Love and a few others are making the assumptions you're making. They are all incorrect. First, perhaps we should address the issue of "We might as well move the conversation over to". That post did exist and it was on that post where this site was attacked viciously by AmandaBear. I banned AmandaBear and of course threw all his foul mouthed comments into the spam bin.

ReplyDeleteWhat followed was somebody suggesting that I was too harsh on trolls because AmandaBear had apparently mended his ways somewhat and had won over many friends on Daneric's site. And therefore I must have been too harsh. So for the benefit of that questioner I released all those spammed comments from AmandaBear so that he could witness them, witness "why" I am harsh on trolls. I do the same for you now and let this be the end of it.